Solar Financing

Empowerloan - Homeowners

In order to qualify for $0-down financing, you must meet the following requirements:

660 FICO and above (exceptions are made based on other factors)

Combined household Income: $40,000+

Borrower’s Name must be on the Title of the property

Apply, its that easy!

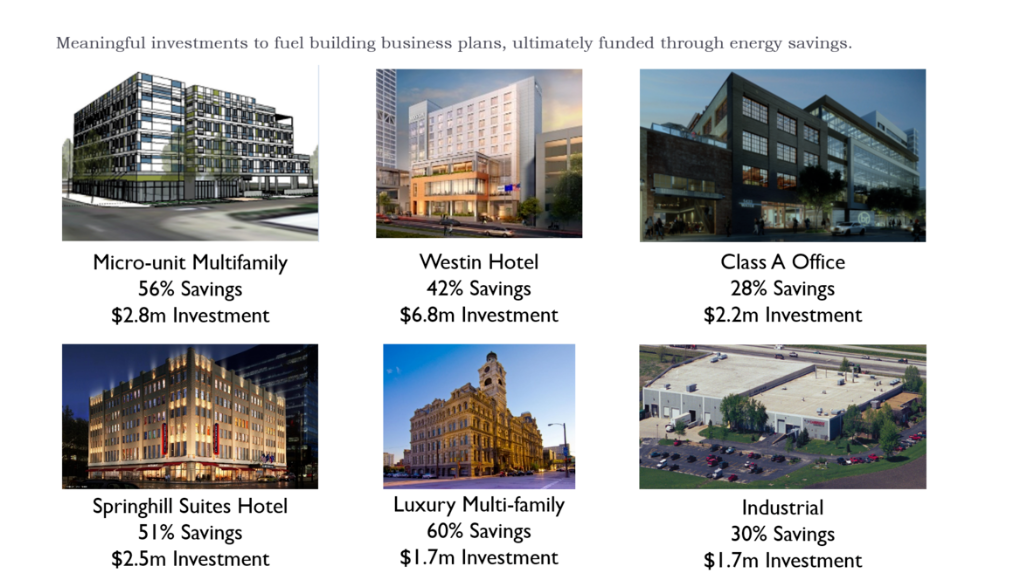

Commercial - PACE (Property Assessed Clean Energy)

Property Assesed Clean Energy is an innovative way for owners to pay for building upgrades. PACE covers 100% of the improvement costs, up to 20% of the buildings value. This financing option has legislation in 32 states.

Non-recourse to owners

Does not impact mortgage LTV ratios (not considered debt)

Transfers upon sale

Can be passed on to tenants as room tax or CAM(common area maintenance) charges.

THE EASIEST FINANCING IN THE INDUSTRY

With same day credit approvals as fast as 30secs!

No funding delays- we use EDOCS which do not require originals and expedite underwriting.

Applications up to $250,000 with no financial statements required.

Each client has the ability to select the financing that maximizes their ROI (Return on Investment). IF you are not satisfied, SolEnergy will bring another financing option from our private lending partners.

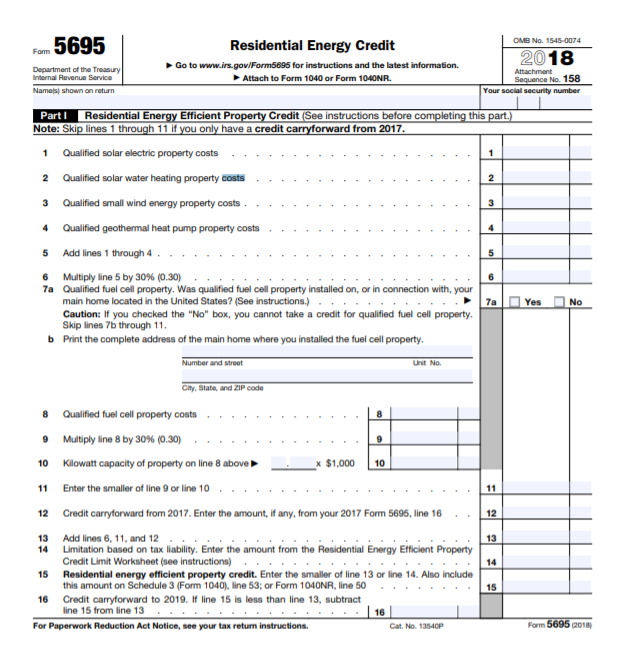

Investment Tax Credit

30% INVESTMENT TAX CREDIT

"The Investment Tax Credit (ITC) is currently a 30 percent federal tax credit claimed against the tax liability of residential (Section 25D) and commercial and utility (Section 48) investors in solar energy property....A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The ITC is based on the amount of investment in solar property."-SEIA

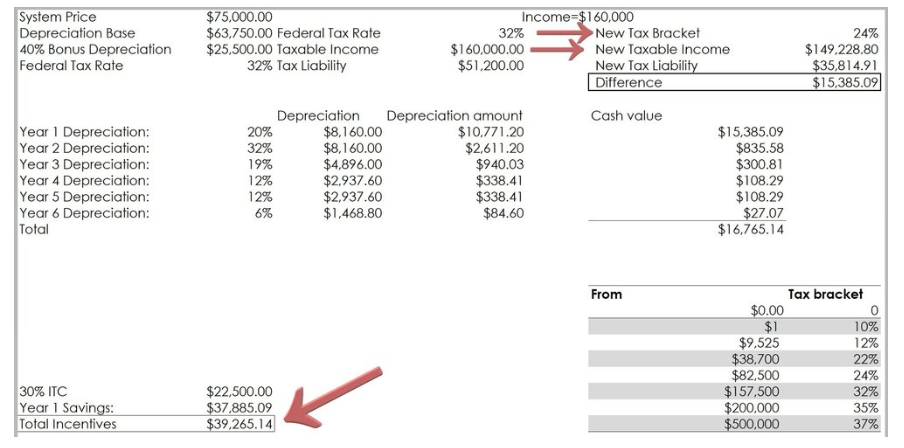

ACCELERATED DEPRECIATION

MACRS(Modified Accelerated Cost Recovery System) is the most commonly used method for reducing tax liabilities. A tax credit is a $1 for $1 credit from the taxes you would be paying. A tax deduction lowers the amount of income you are taxed on. For this method we are deducting 85% of the system cost over 6 years and accelerating it in year one. Sometimes a small deduction can be just enough to lower you an entire tax bracket and have a huge impact. This client got 52% of their investment back in the first year just from the incentives while eliminating their electric bill.